The hidden risk of joint research and other agreements

Helsinn Healthcare S. A. v. Teva Pharms. United States, Inc., 139 S. Ct. 628 (2019)

This decision addresses the question of whether secret sales trigger the on sale bar under the new Section 102(a)(1) of the AIA. The lesson is that activities under a technology license or joint research agreement can unknowingly trigger the on sale bar and its one year deadline by which patent applications need to be filed to avoid forfeiting patent rights.

Helsinn developed the “Aloxi” pharmaceutical product, a drug used to treat vomiting and nausea in the course of chemotherapy treatments. During Phase III clinical trials, Helsinn entered into both a license agreement and a supply agreement with MGI Pharma (a Minnesota company, by the way). Under these, Helsinn would supply 0.25 mg and 0.75 mg dosage products, respectively, to MGI Pharma, and MGI Pharma would market and distribute the products. The parties announced their agreements in joint press releases, so that the existence of the relationship became publicly known. The press releases did not disclose the dosage forms at issue, though. MGI Pharma was obligated to maintain the confidentiality of the Helsinn information and materials. Hence, any material that Helsinn sold to MGI Pharma during the clinical trials was done secretly. Two years after entering the agreements with MGI Pharma, Helsinn filed the priority patent application for the 0.25 mg dosage form. A family of patents issued from this priority application in due course. One of these was the ‘219 patent at issue, which included claims protecting the 0.25 mg product.

Helsinn developed the “Aloxi” pharmaceutical product, a drug used to treat vomiting and nausea in the course of chemotherapy treatments. During Phase III clinical trials, Helsinn entered into both a license agreement and a supply agreement with MGI Pharma (a Minnesota company, by the way). Under these, Helsinn would supply 0.25 mg and 0.75 mg dosage products, respectively, to MGI Pharma, and MGI Pharma would market and distribute the products. The parties announced their agreements in joint press releases, so that the existence of the relationship became publicly known. The press releases did not disclose the dosage forms at issue, though. MGI Pharma was obligated to maintain the confidentiality of the Helsinn information and materials. Hence, any material that Helsinn sold to MGI Pharma during the clinical trials was done secretly. Two years after entering the agreements with MGI Pharma, Helsinn filed the priority patent application for the 0.25 mg dosage form. A family of patents issued from this priority application in due course. One of these was the ‘219 patent at issue, which included claims protecting the 0.25 mg product.

Many years later, TEVA sought FDA approval for a generic 0.25 mg form of the Aloxi product. Helsinn promptly sued TEVA for infringing the ‘219 patent. TEVA defended on grounds that secret sales from Helsinn to MGI Pharma occurred under the license and supply agreements more than one year prior to the filing of the priority application. According to TEVA, the secret sales triggered the one-year on sale bar, which ran before the Helsinn priority application was filed.

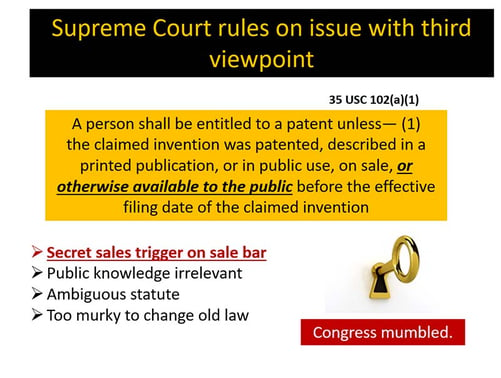

Section 102 enacted under the AIA in 2012 controlled. Prior to the AIA, secret sales could trigger the on sale bar of the old Section 102. Did the newer Section 102 enacted under the AIA change this? The potential for a shift in the law arose due to the use of the phrase “otherwise available to the public” in the new statute (emphasis added):

Section 102 enacted under the AIA in 2012 controlled. Prior to the AIA, secret sales could trigger the on sale bar of the old Section 102. Did the newer Section 102 enacted under the AIA change this? The potential for a shift in the law arose due to the use of the phrase “otherwise available to the public” in the new statute (emphasis added):

35 U.S.C. 102(A) NOVELTY; PRIOR ART

A person shall be entitled to a patent unless— (1) the claimed invention was patented, described in a printed publication, or in public use, on sale, or otherwise available to the public before the effective filing date of the claimed invention;

Section 102(a)(1) does not authorize a one year grace period, and on its face indicates that patent rights are immediately lost if one of the listed events occurs. However, Section 102(b) establishes the one-year grace period with respect to events in Section 102(a), such as an on sale event.

Does the phrase “otherwise available to the public” mean that all the events in the 102(a)(1) list, including the on sale event, necessarily must incorporate a public aspect in order to trigger the one year deadline? This is a tough question to answer, indeed, as the different courts developed different answers first in the District Court, then on appeal to the Federal Circuit, and then on appeal to the U.S. Supreme Court.

The District Court decided that only public sales could trigger the on sale bar of the new Section 102(a)(1). Because the joint press releases issued by Helsinn and MGI Pharma did not disclose the invention but rather disclosed only the existence of the relationship, the secret sales to MGI Pharma did not trigger the on sale bar. The Federal Circuit agreed with the District Court that secret sales would not trigger the on sale bar of the new Section 102(a)(1). This initially suggests that the Federal Circuit would affirm the decision of the district court. This is not what happened. The Federal Circuit still reversed, ruling that the on sale bar had been triggered and ran out before the priority application had been filed. The Federal Circuit determined that the on sale bar had been triggered because the existence of the sales had been made public (via the press releases). With the sales being publicly known, it did not matter that the invention details remained secret.

The District Court decided that only public sales could trigger the on sale bar of the new Section 102(a)(1). Because the joint press releases issued by Helsinn and MGI Pharma did not disclose the invention but rather disclosed only the existence of the relationship, the secret sales to MGI Pharma did not trigger the on sale bar. The Federal Circuit agreed with the District Court that secret sales would not trigger the on sale bar of the new Section 102(a)(1). This initially suggests that the Federal Circuit would affirm the decision of the district court. This is not what happened. The Federal Circuit still reversed, ruling that the on sale bar had been triggered and ran out before the priority application had been filed. The Federal Circuit determined that the on sale bar had been triggered because the existence of the sales had been made public (via the press releases). With the sales being publicly known, it did not matter that the invention details remained secret.

The district court and the Federal Circuit applied two, completely different viewpoints and reached opposite results. The Supreme Court next applied a third judicial viewpoint, which of course controls how this issue is interpreted. The Supreme Court determined that the phrase “otherwise available to the public” in the new statute is too vague to have incorporated a public aspect into all the events listed in the statute. Hence, according to the Court, the old law with regard to secret sales and the on sale bar remained intact after passage of the AIA. This meant that secret sales trigger the on sale bar of Section 102(1)(a), just as was the case under the old law. Helsinn lost its patent to these secret sales, opening the way for TEVA to enter the market with a competing, generic product.

Many technology licenses, joint research agreements, supply agreements, material transfer agreements, and even ubiquitous nondisclosure agreements involve either transfers of products or obligations to supply product to one or more other parties. If these transaction involve a sale or any kind of title transfer (e.g., a company might give away a tool for free in order to create a market for a proprietary consumable), Helsinn teaches that the transfer or undertaking the obligation to supply will trigger the on sale bar, even if the transfer or obligations are secret.

Many technology licenses, joint research agreements, supply agreements, material transfer agreements, and even ubiquitous nondisclosure agreements involve either transfers of products or obligations to supply product to one or more other parties. If these transaction involve a sale or any kind of title transfer (e.g., a company might give away a tool for free in order to create a market for a proprietary consumable), Helsinn teaches that the transfer or undertaking the obligation to supply will trigger the on sale bar, even if the transfer or obligations are secret.

Public knowledge of the transactions might have been relevant to the Federal Circuit, but not to the Supreme Court. This means that secret sales whose existence is secret still trigger the on sale bar under Helsinn.

The result is that any technology-related agreement can unknowingly trigger the on sale bar during pre-commercialization phases of the relationship. This can be particularly problematic under joint research relationships when a product might not exist at the outset, but then is developed and ready for patenting at some intermediate time long before commercialization to third parties occurs. Parties need to stay on top of this issue by either closely monitoring progress and promptly patenting to avoid the running of the one year grace period and/or by placing agreements that do not prematurely setup supply obligations and or material transfers that trigger the on sale bar.